Is the Bitcoin bull market over? Or ready to roar again?

Bitcoin, the world’s largest cryptocurrency, suffered a significant price correction, falling to $94,830 – a drop of more than 12% from its monthly peak.

According to CoinGecko, the decline is due to trading activity slowing over the holidays, with daily trading volume falling to $22 billion on December 29 from $41 billion the day before. Bitcoin typically sees volumes of more than $100 billion, but investor caution and lower participation during the holidays have dampened momentum.

Market factors weighing on Bitcoin

The price drop was attributed to several factors including macroeconomic changes and investor sentiment. The Federal Reserve’s recent monetary policy decision had a decisive impact. In early December, the Fed cut interest rates by 0.25%, implying a less aggressive easing cycle than many forecasts and pointing to two rate cuts in 2025 instead of four. A more hawkish outlook has kept investors cautious on risk assets like cryptocurrencies as traders continue to reposition themselves amid gentle and gradual easing of monetary policy.

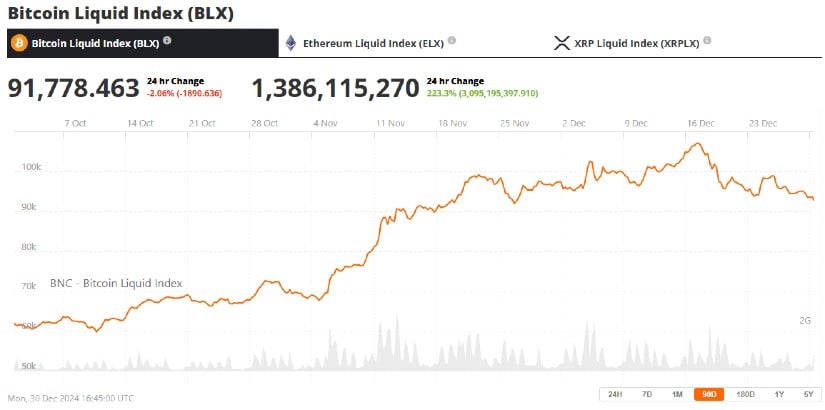

Bitcoin (BTC) price chart. Source: Bitcoin Liquid Index (BLX) above Nice new coin

Additionally, Bitcoin is suffering from waning institutional interest in exchange-traded funds (ETFs). While accumulation from Bitcoin ETFs stands at $35.6 billion in 2024, inflows have slowed. This means institutional investors are wary of making another bet on what appears to be an unclear market. Likewise, doubts about the creation of the much-vaunted Bitcoin strategic reserve have further weakened the uptrend…