Cryptocurrencies are increasingly integrated into modern financial reality and, like all other assets, are subject to taxation.

As a relatively new and rapidly growing asset class, cryptocurrencies are attracting increasing interest from investors and governments. As the global economy adapts to this digital innovation, countries are taking different regulatory and tax approaches to cryptocurrencies. How do cryptocurrency tax policies work worldwide?

In which countries do you have to pay taxes on cryptocurrencies?

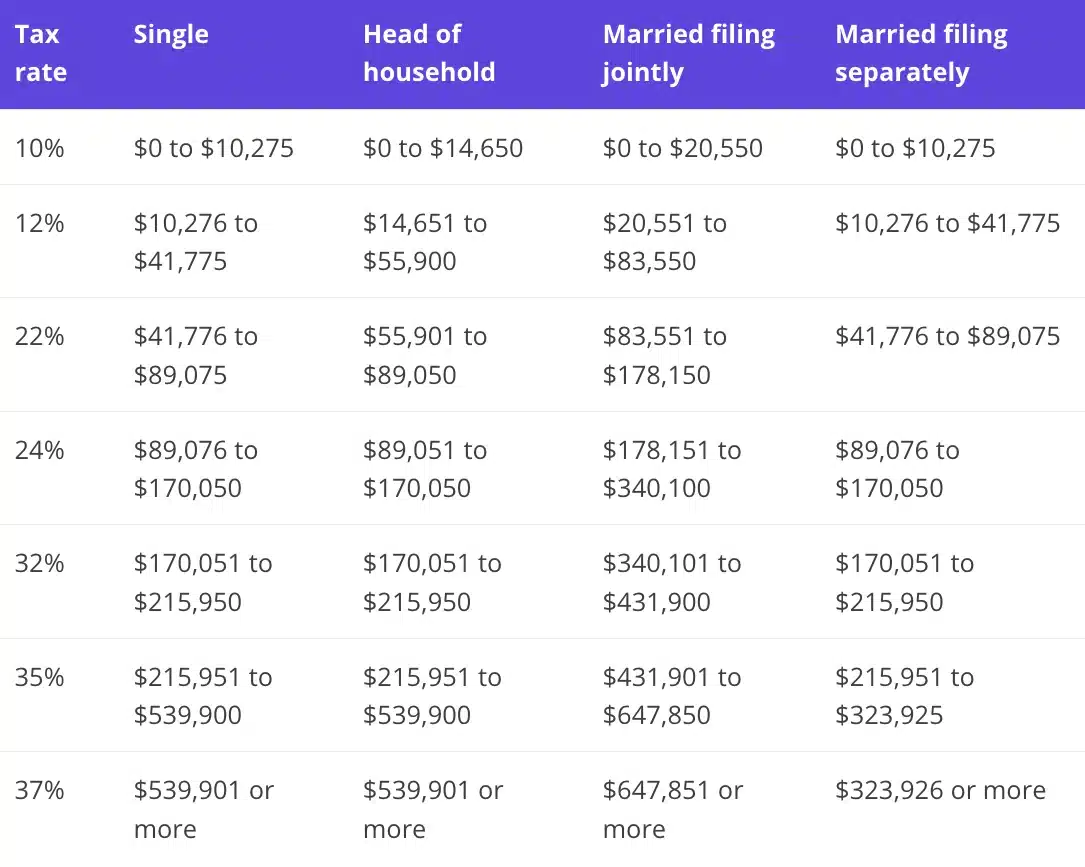

In the United States, it is simply impossible not to pay taxes – the authorities here are very strict and tax almost everything, including digital assets.

Crypto is treated as property and not currency. This means taxpayers must pay capital gains tax when selling cryptocurrencies. The gain is subject to either short-term or long-term capital gains tax depending on how long the asset is held (less than a year or longer).

In the UK the picture is similar: cryptocurrencies are taxed like other assets. Capital gains tax (CGT) applies to income above a tax threshold. If the income from cryptocurrency trading exceeds a certain amount, the taxpayer must file a tax return and pay taxes.

The Australian Tax Office also classifies cryptocurrencies as assets. Investors must pay capital gains tax when they sell their tokens for a profit. However, there is a small clarification: in some cases, cryptocurrencies used to purchase goods and services may be exempt from tax if the transaction amount does not exceed $10,000.

In total,…