In recent months, the Bitcoin market has seen a surge in private transactions, particularly through CoinJoin, a process that improves privacy by pooling multiple users’ Bitcoin transactions.

According to CryptoQuant CEO Ki Young Ju, this increase is related to growing institutional interest, including Bitcoin ETFs, large accumulators like MicroStrategy, and unidentified large Bitcoin holders known as “whales.”

The Rise of Private Transactions: A Strategic Shift

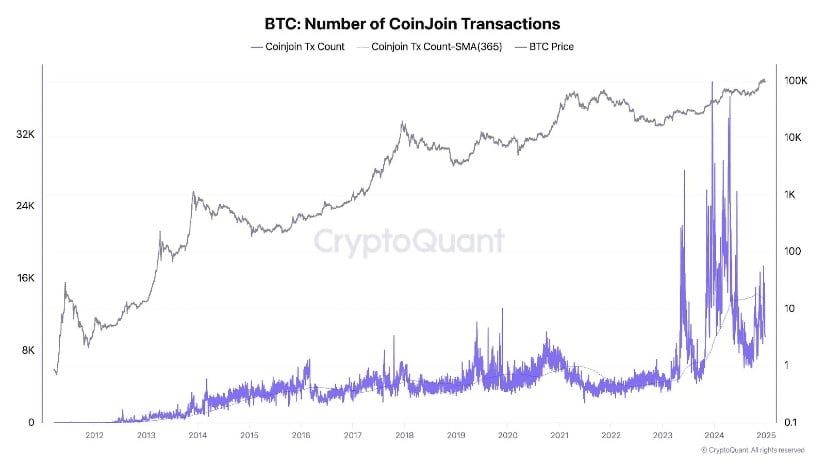

Since 2022, private Bitcoin transactions have tripled. This dramatic increase comes as major institutional players increased their purchases. CryptoQuant’s Ki Young Ju explains that these whales often use privacy features like CoinJoin to transfer Bitcoin to new institutional investors. The privacy mechanism helps obscure the origin and destination of Bitcoin, a move often associated with avoiding scrutiny and protecting the identities of the investors involved.

The rising trend in private Bitcoin (BTC) transactions. Source: Ki Young Ju about X

Despite concerns about possible misuse of CoinJoin by criminal actors, Ju dismissed claims that the tool is primarily used to launder stolen funds. In fact, Chainalysis reported that losses from Bitcoin hacking in 2024 amounted to $2.2 billion, a small fraction of Bitcoin’s realized market capitalization, underscoring that only a small portion of Bitcoin flows through illicit Activities are impaired.

As the narrative around privacy and Bitcoin evolves, the mainstream focus remains on the institutional forces at play.

Institutional Giants and the Rise of Bitcoin ETFs

Institutional actors have…