Bitcoin exchange-traded funds (ETFs) in the US showed different trends this week. They initially started the week with record inflows before later experiencing massive outflows.

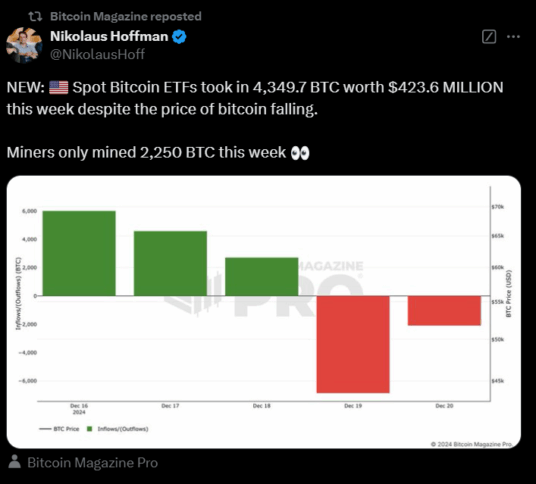

According to data compiled by Bitcoin Magazine, US spot Bitcoin ETFs collectively purchased 4,349.7 BTC worth $423.6 million as the price of Bitcoin fell. During the same period, Bitcoin mining produced 2,250 BTC, meaning there is very strong demand for Bitcoin.

Bitcoin price rose earlier in the week to peak above $108,000 on December 17 as investors felt good and awaited a rate cut from the Federal Reserve. Bitcoin reached its all-time high of $108,000 mid-week before starting to fall sharply. On December 19, Bitcoin rose to $93,145.17, falling 9.2% in just 24 hours. That triggered a market sell-off and led to $1 billion worth of cryptocurrency liquidations…