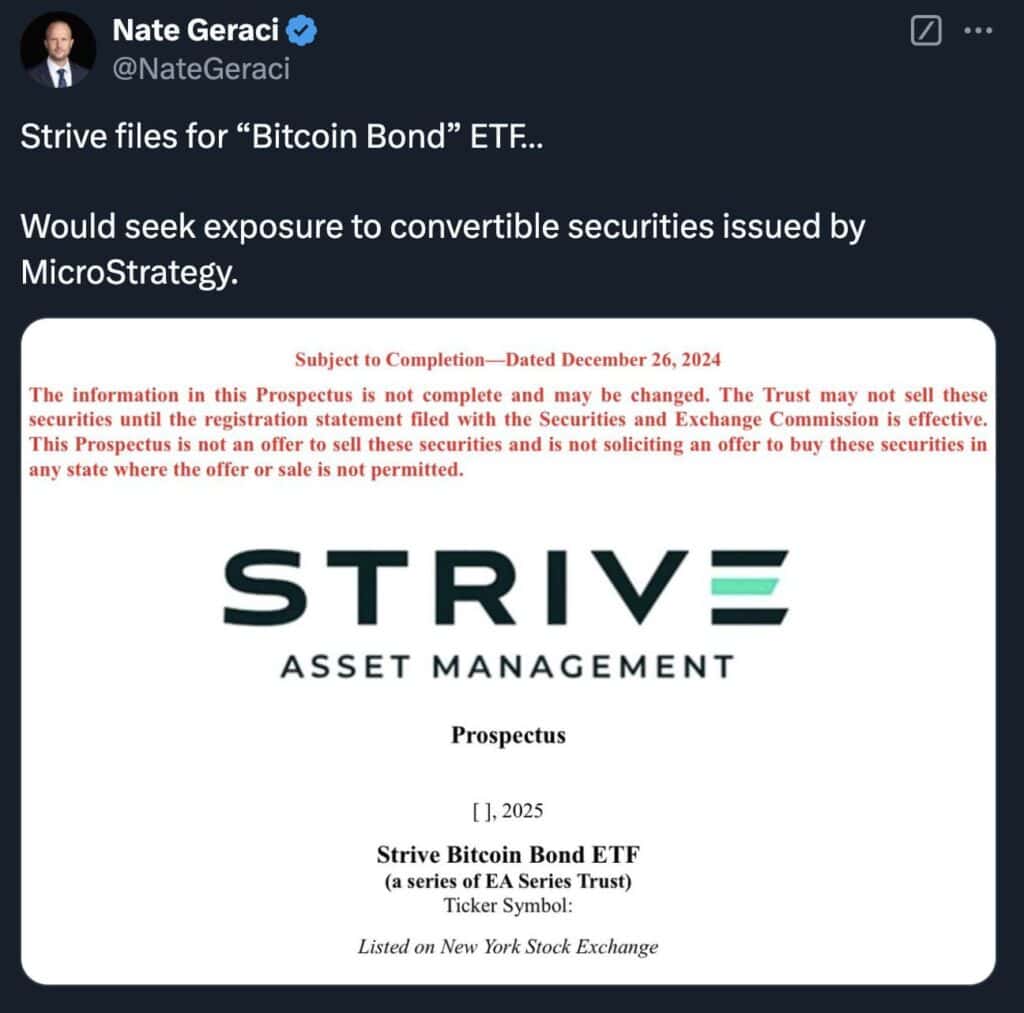

Strive Asset Management, led by billionaire entrepreneur and politician Vivek Ramaswamy, has filed a proposal with the US Securities and Exchange Commission (SEC) to launch an exchange traded fund (ETF) focused on Bitcoin-linked convertible bonds.

This product, the Strive Bitcoin Bond ETF, is intended to provide retail and institutional investors with simplified access to financial instruments linked to the performance of Bitcoin.

A new approach to Bitcoin investing

In a Dec. 27 announcement on social platform X, Strive Asset Management said: “Strive’s first of many planned Bitcoin solutions will democratize access to Bitcoin bonds and make these high-potential instruments accessible to everyday investors.”

Source: X

Bitcoin bonds, issued by companies to finance Bitcoin acquisitions, are touted for their unique risk-reward profile. However, such instruments remain largely inaccessible to the average investor due to their complexity and exclusivity. Strive’s ETF aims to change this landscape by providing a streamlined path to investing in Bitcoin-related financial products.

The ETF will focus on securities from companies like MicroStrategy, an enterprise Bitcoin pioneer. Under the leadership of CEO Michael Saylor, MicroStrategy has purchased approximately $27 billion worth of Bitcoin since 2020. These acquisitions were financed through equity raises and convertible bonds – debt instruments that can later be exchanged for equity under certain conditions.

Source: X

This is how the ETF works

According to the SEC filing, the Strive Bitcoin Bond ETF is actively managed and seeks exposure to Bitcoin-linked bonds through direct…