According to a recent report from Citi, the cryptocurrency market is poised for significant growth in 2025, driven by increasing adoption of stablecoins and the continued rise in exchange traded funds (ETFs).

These developments are expected to result in positive price performance and expand the crypto ecosystem despite ongoing macroeconomic uncertainty.

Main driver of crypto growth

Analysts at Citi said 2025 could be a pivotal year for digital assets, citing several factors that will drive this market. Strong catalysts include the increasing adoption of stablecoins to strengthen DeFi markets and the expansion of crypto ETFs, enabling easier access and greater institutional presence in this space.

Source:X

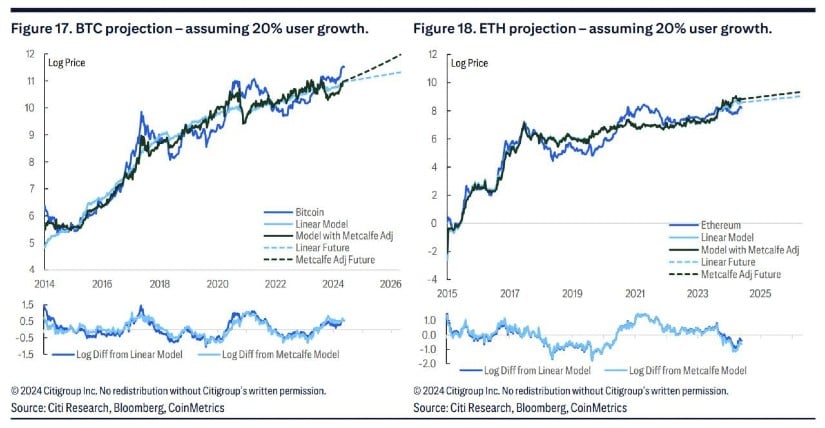

“In our view, adoption is the most important concept to pursue in terms of the long-term performance of cryptocurrencies,” Citi’s report said. According to the company, increasing ETF activity and stablecoin market cap are two signs of a growing crypto ecosystem.

The role of ETFs and institutional inflows

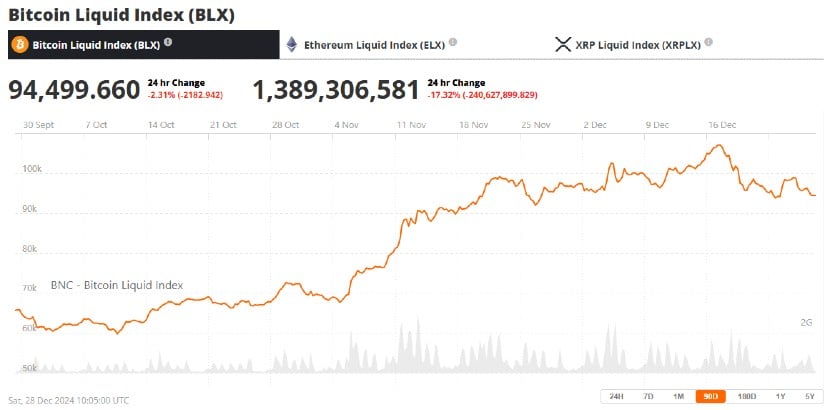

One of the main drivers of this crypto rally is exchange-traded funds, which are reportedly seeing massive inflows from Bitcoin ETFs. For this year alone, nearly 46% of BTC price movements could be attributed to inflows from the aforementioned Bitcoin ETFs in 2024, according to Citi. These inflows directly impact prices, with $1 billion in ETF investments producing a return of approximately 4.7%. In November 2024, Bitcoin ETFs surpassed $100 billion in net assets, signaling growing institutional interest in the sector.

Bitcoin (BTC) price chart. Source:Bitcoin Liquid Index (BLX) above Nice new coin

The approval of…