As Donald Trump prepares for his second term as US President, the crypto community is eagerly awaiting the possible impact of his pro-Bitcoin rhetoric on government policy.

While Trump has championed positive crypto initiatives, including the idea of a national Bitcoin reserve, industry leaders remain cautious about the viability of such promises.

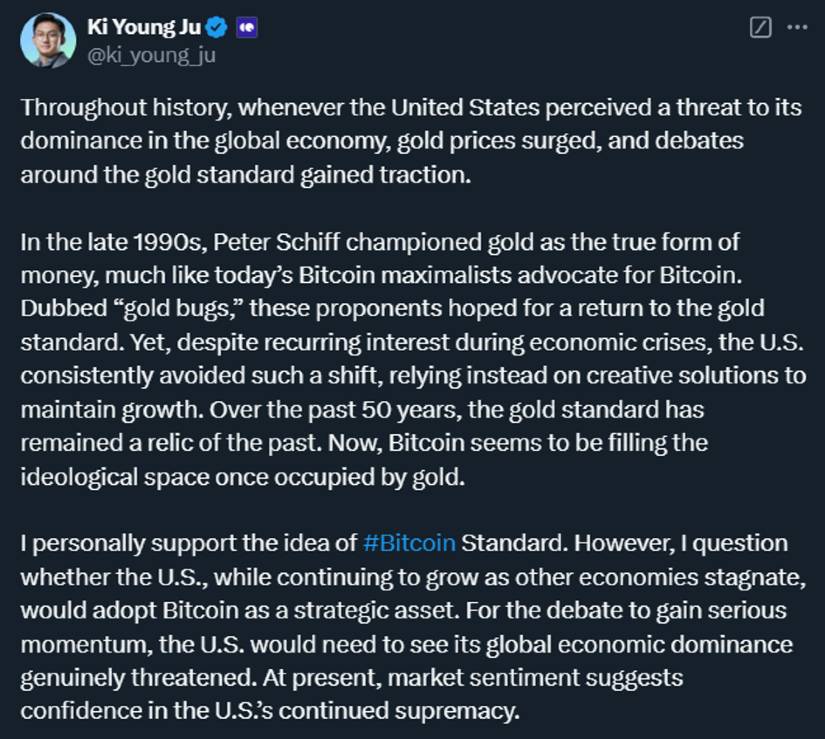

Supremacy between Bitcoin and Dollar

According to Ki Young Ju, CEO of CryptoQuant, the US government’s policy towards Bitcoin is closely linked to the country’s dollar superiority. He says Bitcoin – popularly referred to as “digital gold” – tends to thrive during times of economic turmoil. For decades, the price of gold rose whenever there was a noticeable slowdown in the US economy. That has changed today as Bitcoin is promoted as a hedge against inflation and financial collapse.

Source:X

However, Ju says that using Bitcoin as a strategic reserve asset will remain out of reach as long as the US dollar continues to maintain its position as a global safe haven.

He added: “In emerging markets where local currencies are rapidly depreciating, people still want US dollars over Bitcoin or gold.”

The political rhetoric behind pro-Bitcoin politics

During the election campaign, Trump promised to introduce Bitcoin as a strategic reserve to modernize US monetary policy. But analysts like Ju believe these promises are more about politics than persuasion.

Finally, Trump’s rhetoric appeared to focus heavily on US economic dominance – something that could be at odds with the promotion of a decentralized asset that is seen as a threat to the dollar’s dominance.

Ju thinks…