Three major crypto advocacy groups have filed a lawsuit against the US Internal Revenue Service (IRS), claiming that the agency exceeded its authority by classifying decentralized finance (DeFi) platforms as brokers under newly issued regulations.

On December 27, the IRS and Treasury expanded the definition of a “broker” to include decentralized exchanges and other DeFi front-end services. This move forces these platforms to report all digital asset transactions, including details of the taxpayers involved, to increase transparency in the crypto market. The mandate comes into force in 2027.

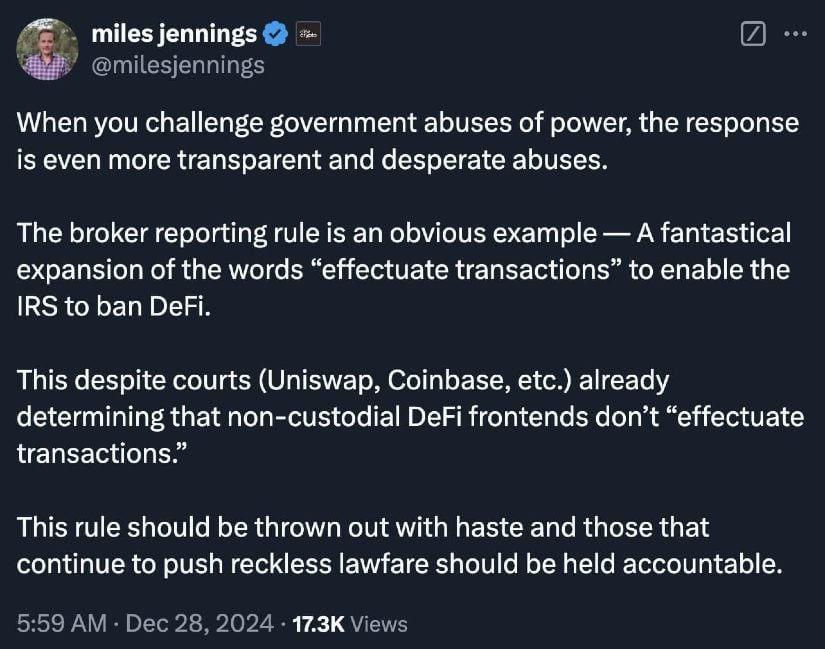

Critics in the crypto community argue that by extending broker duties to DeFi operators, the IRS is placing excessive compliance burdens on software developers, particularly those who create trading interfaces. Bill Hughes, an attorney at Consensys, called the timing of the rule’s release — during a holiday season — a calculated decision “to minimize industry opposition.” Miles Jennings, general counsel at a16z Crypto, described the new requirement as “a drastic overreach” aimed at curbing DeFi operations.

Source: X

Legal challenge

Three advocacy organizations – the Blockchain Association, the DeFi Education Fund and the Texas Blockchain Council – filed a joint lawsuit on December 27th. They claim that the IRS’s expanded broker definition violates the Administrative Procedure Act (APA) and violates privacy and constitutional rights.

“This case involves unlawful and unconstitutional overreach by the Treasury Department and the Internal Revenue Service,” explains the…