Hyperliquid, an emerging player in the decentralized perpetual futures market, is under intense scrutiny following allegations of wallet activity linked to North Korean hackers.

The allegations have led to significant outflows, a sharp drop in the token price and questions about the platform’s security infrastructure.

North Korean claims of exploitation emerge

The controversy began when Taylor Monahan, a security expert at MetaMask, claimed that wallets linked to the Democratic People’s Republic of Korea (DPRK) were trading Ethereum (ETH) on Hyperliquid. Monahan claimed that the transactions were not standard transactions but rather potential vulnerability tests targeting the platform. “DPRK does not engage in trade. “DPRK is testing,” Monahan claimed in a social media post.

Her allegations caused widespread panic among hyperliquid users. Data from Dune Analytics revealed that over $256 million in funds were withdrawn from the platform in just 30 hours, with net outflows of over $502 million recorded on December 23 alone.

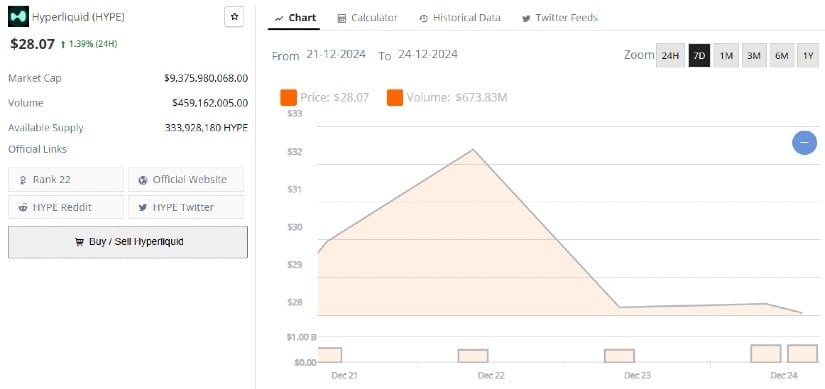

Hyperliquid (HYPE) price chart. Source: Nice new coin

Hyperliquid’s native token plunged over 25%, falling from $34 to $25 before stabilizing at $27. Although the price has since recovered, the controversy has weakened investor confidence in the platform.

Hyperliquid denies allegations

In response to the escalating concerns, Hyperliquid Labs released a statement denying any security breach. “There was no North Korea exploit – or any exploit at all – of Hyperliquid. All user funds will be accounted for,” the platform assured via its Discord channel.

The company emphasized its commitment to security and pointed to its bug bounty program…