The number of U.S. banks facing major problems continues to rise, according to new figures from the Federal Deposit Insurance Corporation (FDIC).

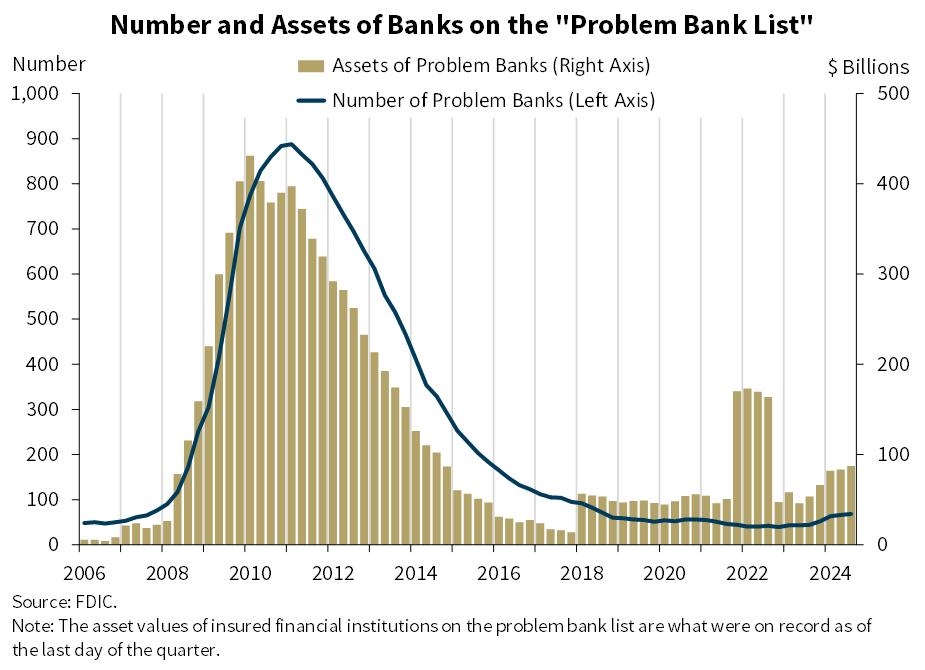

In its quarterly bank profile report, the FDIC said the number of U.S. lenders on its “problem bank list” increased to 68 in the third quarter.

The figure represents the fifth quarterly increase in the number of banks receiving a rating of 4 or 5 in the CAMELS rating system since the second quarter of 2023.

A lender with a CAMELS rating of 4 indicates that the company has financial, operational or managerial weaknesses – or a combination of these problems – which, if left unaddressed, could reasonably jeopardize its soundness. Meanwhile, a bank with a score of 5 in the CAMELS system indicates that it has critical deficiencies in one or more areas and requires urgent remedial action.

“The total assets of problem banks increased by $3.9 billion to $87.3 billion. Problem banks make up 1.5 percent of the total Banks, which in non-crisis times is in the normal range of 1 to 2 percent of all banks.”

Meanwhile, the amount of unrealized losses on banks’ balance sheets has declined.

According to the FDIC, banks are burdened with $364 billion…