Ethereum price has declined sharply in recent days after facing significant resistance at $4,000.

Ethereum (ETH) traded at $3,340 on Monday as the cryptocurrency stabilized. This was a slight increase from last week’s low of $3,100.

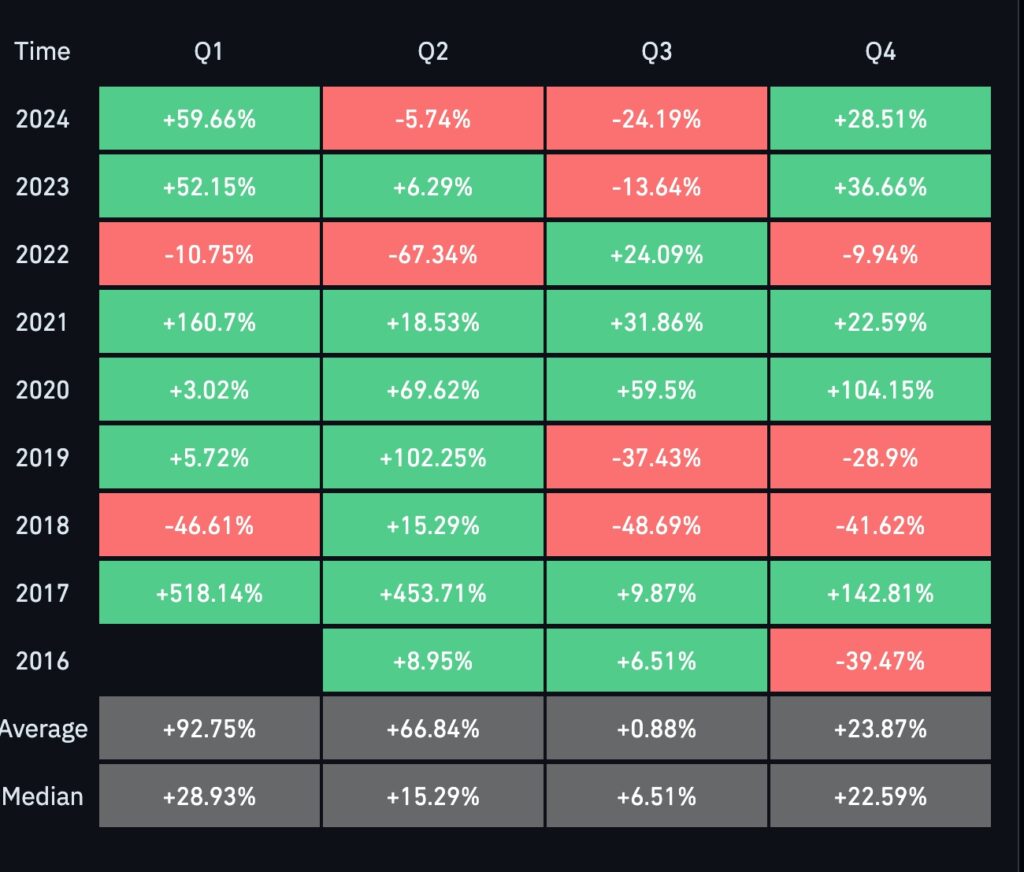

Seasonality data suggests that Ethereum price could rise sharply in the first quarter of 2025. According to CoinGlass, ETH has seen positive returns in all but two first quarters since 2017. Its best performance was in 2017 when it rose 518%, followed by 202.1 when it rose 160%.

The average first quarter return since 2017 was 92%, making it the best period of the year. The second quarter is the best quarter, followed by the fourth quarter. The third quarter is usually the worst time for cryptocurrencies, probably due to the summer season.

More data shows Ethereum rising in the first four months after a US election. The average return in the first four months of Donald Trump’s term was around 90%. Also in 2021, the four-month return after Biden took office was $41.

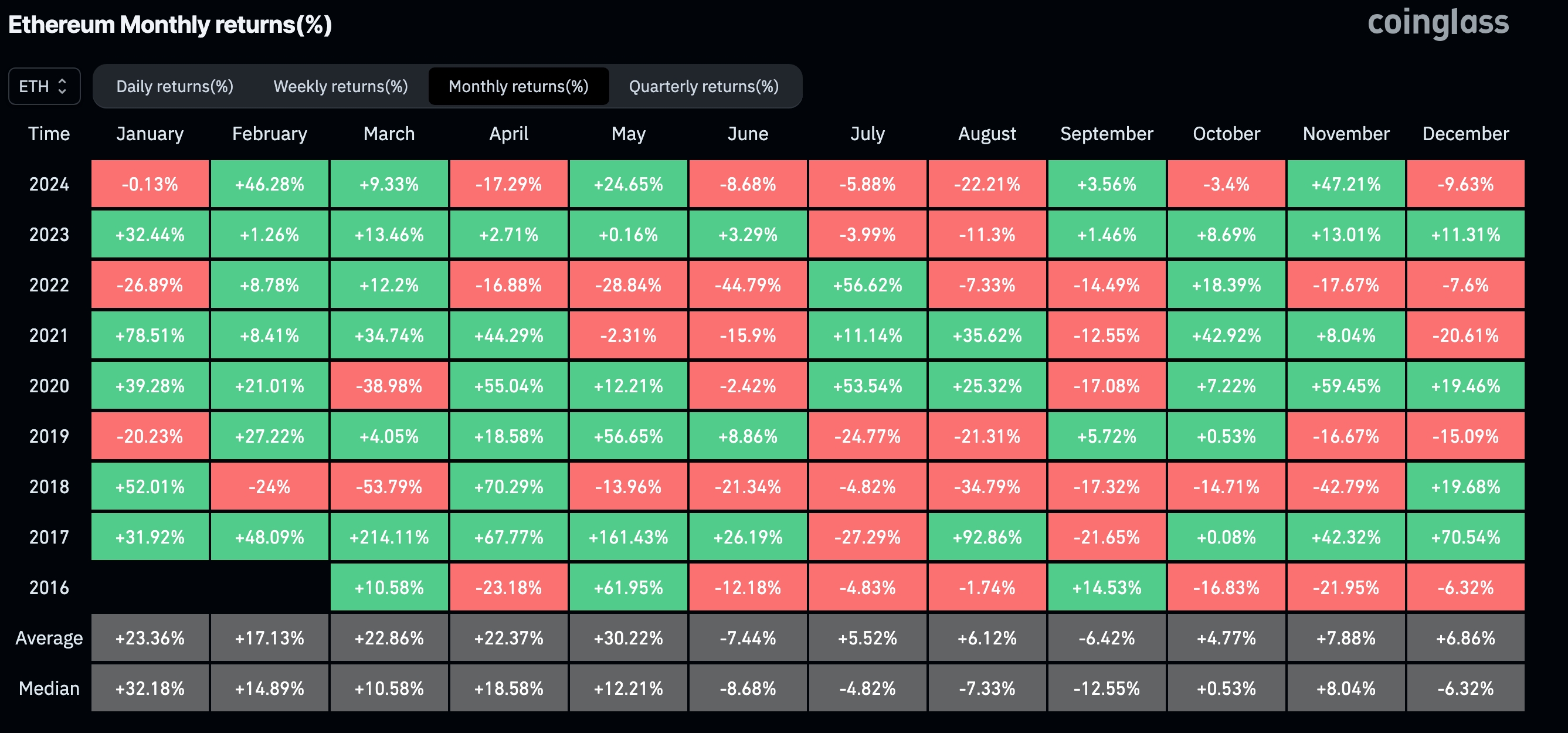

To be clear, seasonality data is not always a good indicator of what to expect. In his case, Ethereum fell in January 2024, 2022 and 2019, and this one could be one of them.

On the positive side, Ethereum price has some strong fundamentals. ETH spot ETFs are seeing strong accumulation among investors, with their cumulative inflows rising to over $2.33 billion.

Ethereum’s network has earned over $2.44 billion in fees this year, making it the second most profitable network…