The just-ended 2024 set a new benchmark for the ETF industry, with Bitcoin ETFs contributing massively to the historic total net inflows of $1.14 trillion.

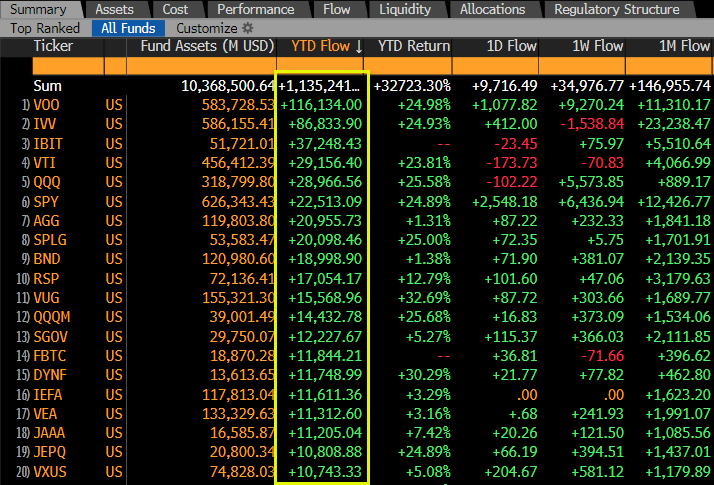

The BlackRock Bitcoin ETF (IBIT) secured $37.25 billion in assets in its first year of trading. Accordingly According to Eric Balchunas, senior ETF analyst at Bloomberg, this significant number places it third in the final top 20 ETF rankings for 2024.

This rapid growth for an ETF that is less than a year old underscores the growing institutional interest in cryptocurrencies, particularly Bitcoin.

Top ETFs for 2024 with record $1 trillion inflows

Meanwhile, the Vanguard S&P 500 ETF (VOO) and the iShares Core S&P 500 ETF (IVV) took the top two spots. VOO closed 2024 with a massive inflow of $116 billion, an incredible $65 billion more than its previous record. Likewise, IVV closed with assets of $89 billion.

Despite their dominance, IBIT’s rapid rise in less than a year after launch shows that investors are increasingly looking to diversify into digital assets via ETFs.

Notably, total inflows into mainstream ETFs in 2024 broke records with $1.14 trillion flowing into the sector. This figure represents a 25% increase over the previous year, representing a total wealth increase of $225 billion.

Bitcoin ETF market with record inflows

Apart from BlackRock’s IBIT, no other crypto investment product made it into the top ten rankings with the highest inflows in 2024. BlackRock’s closest competitor, the Fidelity Wise Origin Bitcoin Fund (FBTC), ranked with a one-year inflow of 11.84 billion US dollar ranked 14th. For comparison, BlackRock’s ETF inflow for 2024 was…