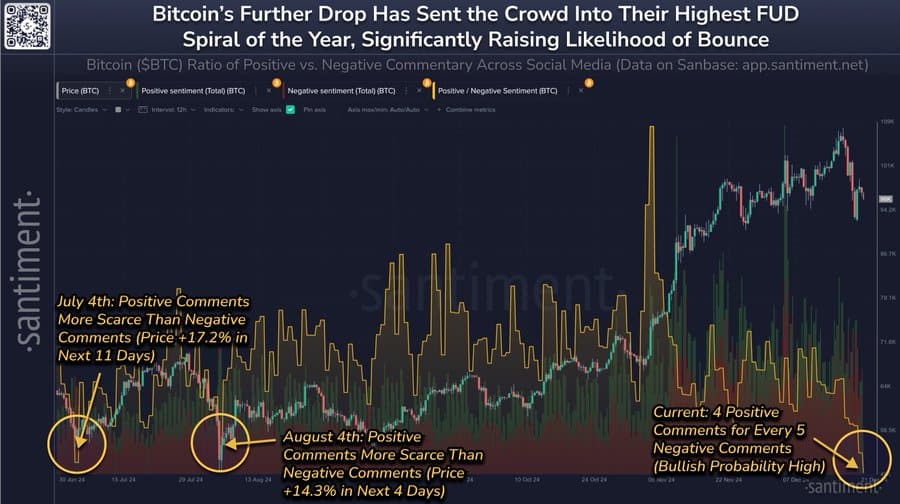

Social sentiment for Bitcoin has fallen to its lowest point in 2024, potentially laying the groundwork for a significant price breakout. In the past, major crypto market rallies have often been preceded by negative sentiment, and this time it may be no different for the world’s leading cryptocurrency.

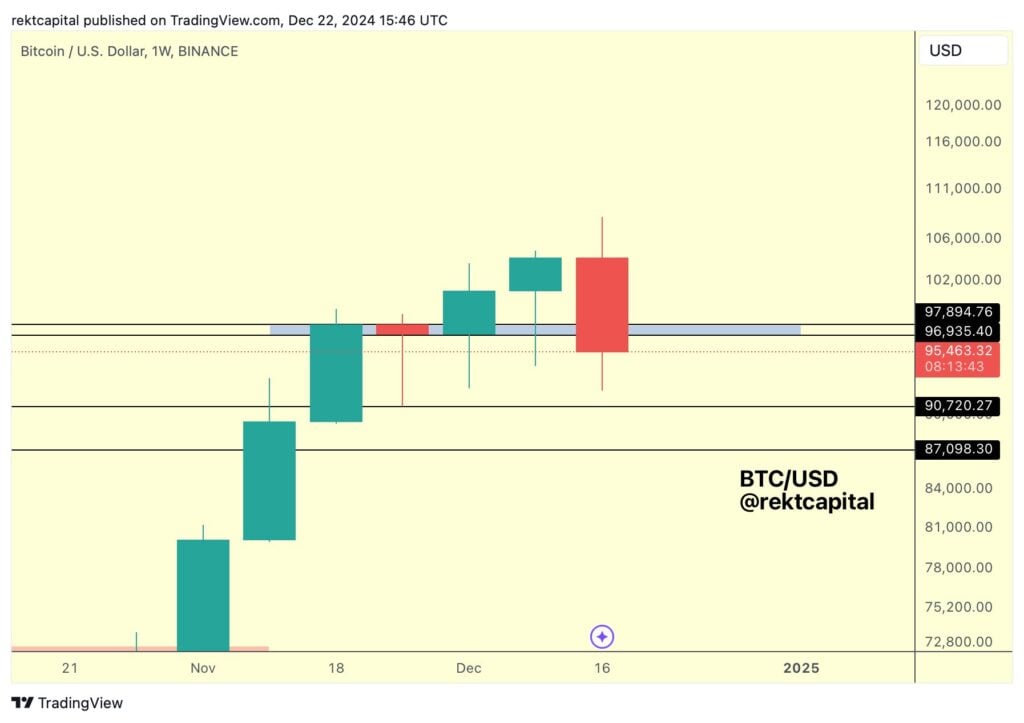

Accordingly, the price of Bitcoin, currently around $97,150 as of 12:38 UTC, is more than 10% below its December 17 all-time high of $108,300 BNC data. This decline comes amid a broader correction in the crypto market, where Bitcoin’s daily charts have produced consecutive red candles for the first time since early November.

Source: BNC Bitcoin Liquid Index

The downturn has also affected Bitcoin The mood in society fell to its lowest level of the yearwith a ratio of four to five positive to negative comments on Bitcoin-related topics across all social platforms. This metric, often a contrarian indicator, suggests that the current wave of fear, uncertainty and doubt (FUD) among retail investors could be paving the way for a market turnaround.

Market intelligence platform Santiment highlighted this trend in a December 22 post. Vocal traders are now showing heavy FUD, and that’s good news for opponent Who knows that markets will move in the opposite direction to retail expectations?”

Source: X

Trader and analyst Rekt Capital wrote: “Bitcoin is in danger of losing each of these supports. These supports must remain in place if BTC wants to avoid a transition into a correction. The weekly closing price below would be bearish.

Share.