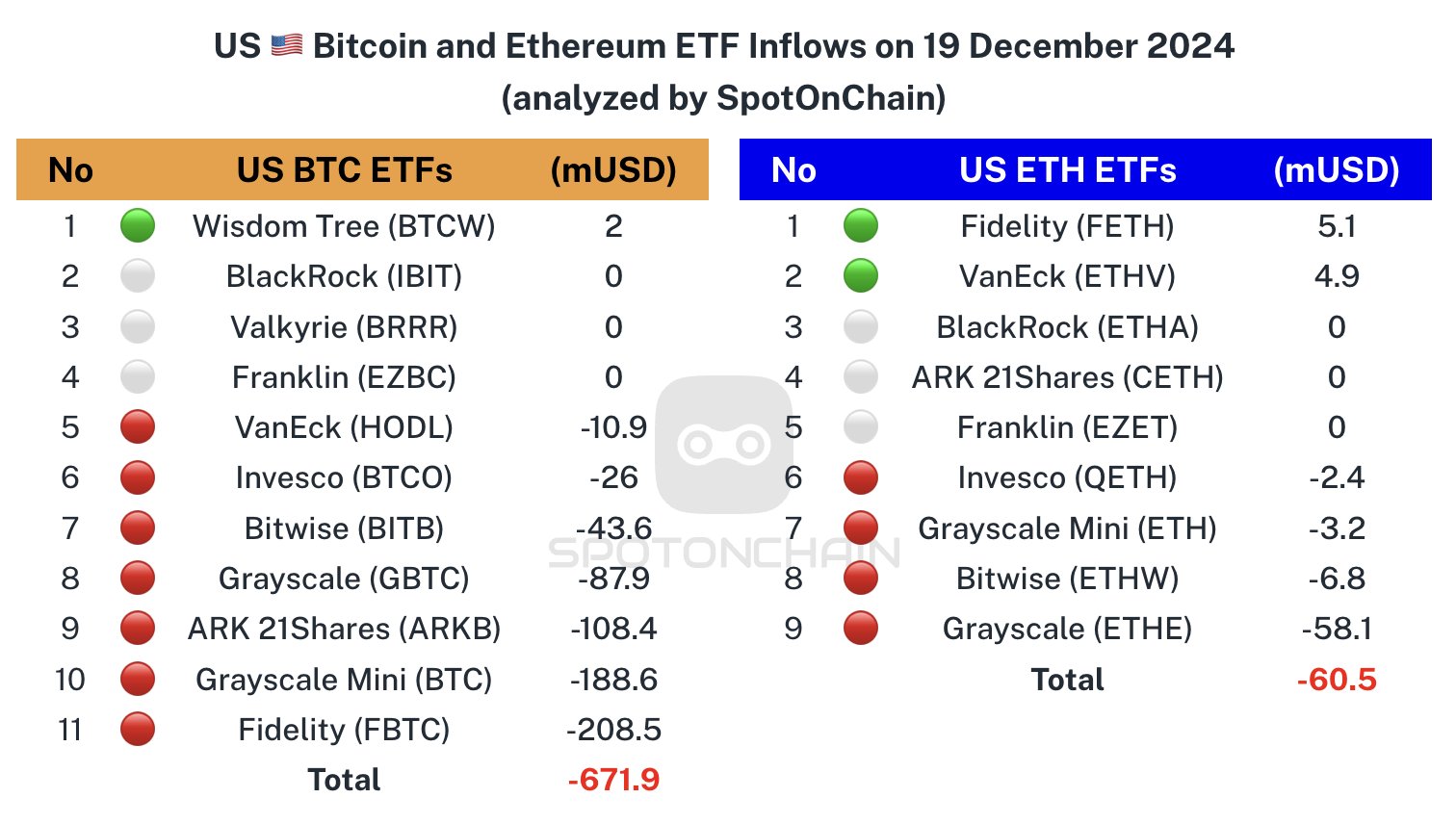

New data from a crypto insights platform shows that Bitcoin (BTC) exchange-traded funds (ETFs) recorded the largest single-day net outflows since their launch in January.

In a new thread on the social media platform

According to Spot On Chain, Fidelity’s FBTC was the ETF that led in terms of total outflows, while BlackRock’s IBIT ETF was trending sideways. December 19th also marked the end of a 15-day inflow streak for Bitcoin ETFs.

“US BTC ETFs just saw their LARGEST net outflow since launch: $671.9 million. Fidelity’s FBTC led the outflows with a record $208.5 million, while BlackRock’s IBIT remained stable with a net outflow of $0.

This also marked the end of a 15-day inflow streak for BTC ETFs and an 18-day streak of inflows for ETH ETFs. In the last 24 hours, BTC is down 4.22% and ETH is down 7.97%.”

According to blockchain tracker SoSoValue, other BTC ETFs saw notable outflows, including Grayscale’s GBTC with $87.86 million; ARK Invest’s ARK 21Shares ARKB with revenue of $108.35 million; VanEck’s HODL generated $10.91 million and Invesco’s BTCO generated $25.97 million.

The leading crypto asset by market cap is trading for $97,417 at the time of writing. It peaked at around $108,000 on December 17th.

Don’t miss a thing – Subscribe to receive email alerts straight to your inbox

Check price action

Keep following us XFacebook and Telegram

Surf the Daily Hodl Mix