The rise of the crypto world in 2024 set the stage for broader possibilities in 2025. Stablecoins, for example, have become an integral part of the financial landscape. By combining traditional finance and crypto, they have enabled seamless global transactions and hedged against currency volatility.

The crypto industry is booming with momentum and the year 2025 promises seismic changes. After Bitcoin surpassed $100,000 in 2024, the digital asset gained widespread notoriety. Major milestones such as the debut of Bitcoin and Ethereum ETFs and the global adoption of stablecoins have supported this development. Meanwhile, a victorious US presidential election campaign underscored his pro-Bitcoin stance and marked a new era for the sector.

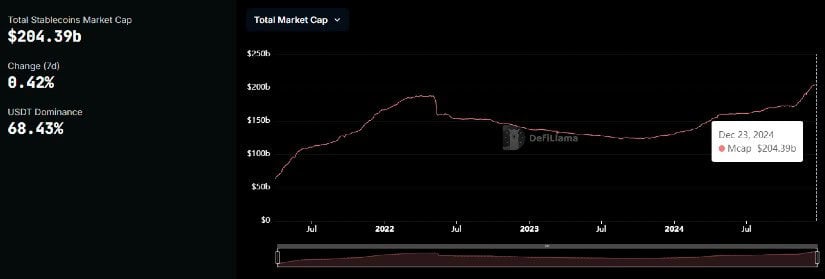

According to DefiLlama, the supply of stablecoins, currently at $200 billion, could double by next year and exceed $400 billion.

Source: DefiLlama

Bitcoin’s rise as a financial cornerstone could soon extend to national reserves. The US proposal for a strategic Bitcoin reserve sparked debate and suggested a global domino effect. Countries mindful of Bitcoin’s limited supply and store of value capabilities could diversify their reserves to include digital gold, reshaping the international financial system.

The launch of Bitcoin ETFs raised $109 billion in the year

In 2024, the introduction of Bitcoin ETFs made history. According to SoSoValue, over $109 billion in assets were withdrawn in a year. These funds opened the doors to institutional and private investors alike. BlackRock, Fidelity and Ark Invest championed these financial products, paving the way for broader cryptocurrency-focused ETFs. Following Bitcoin’s example, Ethereum ETFs are coming to market and are expected to…