Ethereum (ETH) could overtake Bitcoin (BTC) in January 2025, according to analysts predicting a possible rise in the altcoin market.

Michael van de Poppe, founder of MN Capital, believes that ETH’s relative strength against BTC, as measured by the ETH/BTC ratio, could break 0.04 – a level not seen since December 2024. Altcoin run.”

Historical performance signals positive momentum

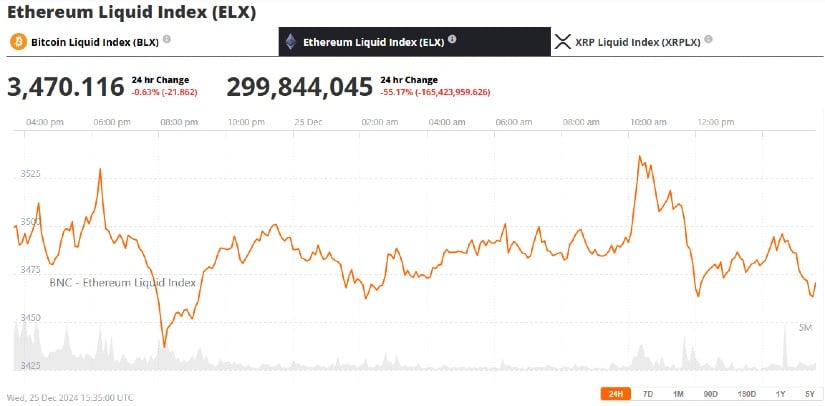

Ethereum (ETH) price chart. Source: Ethereum Liquid Index (ELX) above Nice new coin

Ethereum’s track record in the first quarter highlights the potential for significant gains. According to Coinglass data, ETH saw an average increase of 92% in the first quarter since 2017, with an average growth of 23% in January alone. This historical precedent provides a strong basis for optimism regarding price activity in early 2025.

Bitcoin (BTC) price chart. Source: Bitcoin Liquid Index (BLX) above Nice new coin

Additionally, Ethereum’s current market behavior suggests upside potential. At the end of December, the ETH/BTC ratio increased by 3.26% in 30 days while ETH hovered around $3,472. Bitcoin, on the other hand, was trading at $98,805, slightly below its record-breaking six-figure milestone, CoinMarketCap reported.

Institutional Acceptance and ETF Trends

Spot Ether Exchange Traded Funds (ETFs) are attracting growing institutional interest, further increasing Ethereum’s appeal. Nate Geraci, President of The ETF Store, commented that net inflows into ETH ETFs are keeping pace with gold ETFs, indicating a shift of institutional investors towards Ethereum. He expects inflows to accelerate in 2025…