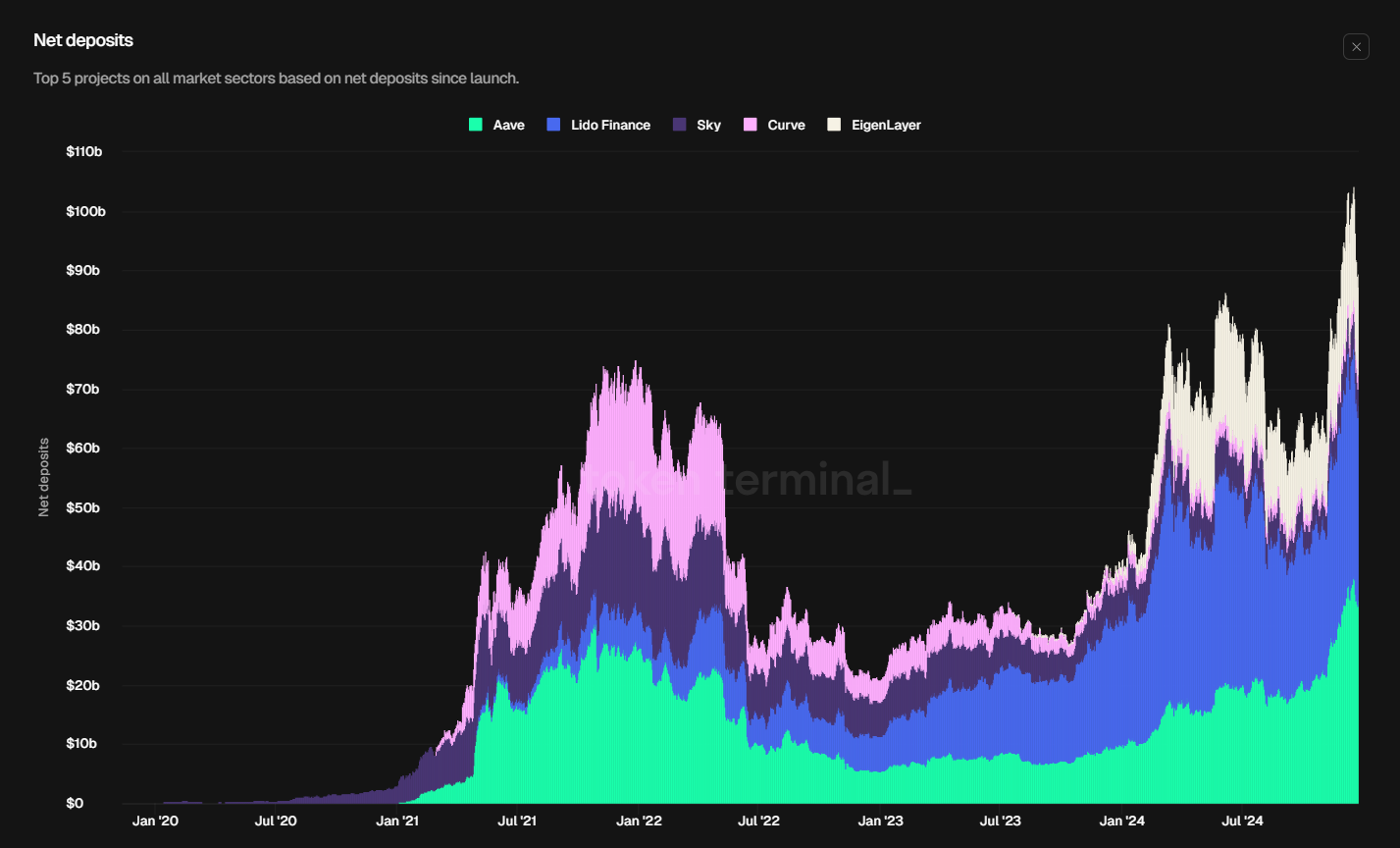

According to Token Terminal, Aave and Lido together have reached more than $70 billion in net deposits for the first time in history.

Aave (AAVE) is at the top with $34.3 billion, just ahead of Lido Finance (LDO) with $33.4 billion. The two protocols together account for 75.25% of the $89.52 billion allocated to the top five decentralized applications, the highest ever in December 2024. The two projects together account for 45.5% of the total funding , allocated to the top 20 DeFi applications, representing $67.42 billion of the sector’s total net deposits of $148 billion. In terms of total value, LDO leads the way with $33.8 billion, followed by AAVE with $20.6 billion.

Overall, the DeFi sector has seen growth, with TVL increasing 107% year-to-date and peaking at $212 billion on December 16, marking the first time ever that this value has surpassed $200 billion. mark exceeds.

The sales development also illustrates the strength of these protocols. AAVE earned $12.5 million in the last 30 days, growing 27.5%, and LDO reached $9.6 million thanks to platform growth of 24%.

Beyond deposits, the DeFi ecosystem also marked a record in trading volume for decentralized exchanges, reaching nearly $380 billion in volume in November, according to TheBlock. In fact, the share of trading volume transacted through DEXes as opposed to centralized exchanges reached 13.86% in October, the second highest…