Amid a largely bearish market, XRP continues to show bullish momentum signals, with the Williams Alligator indicator providing key insights.

XRP, which crossed the crucial $2 mark earlier this month, has analysts closely watching its trend continuation potential. The asset has plunged at least 30% since approaching the $3 mark this month.

In a post on This tool uses three moving averages (jaws, teeth and lips) to identify market trends.

According to Egrag, XRP’s current direction of these moving averages suggests bullish momentum, assuming XRP maintains its position above the equilibrium zone without falling back.

What the diagrams reveal

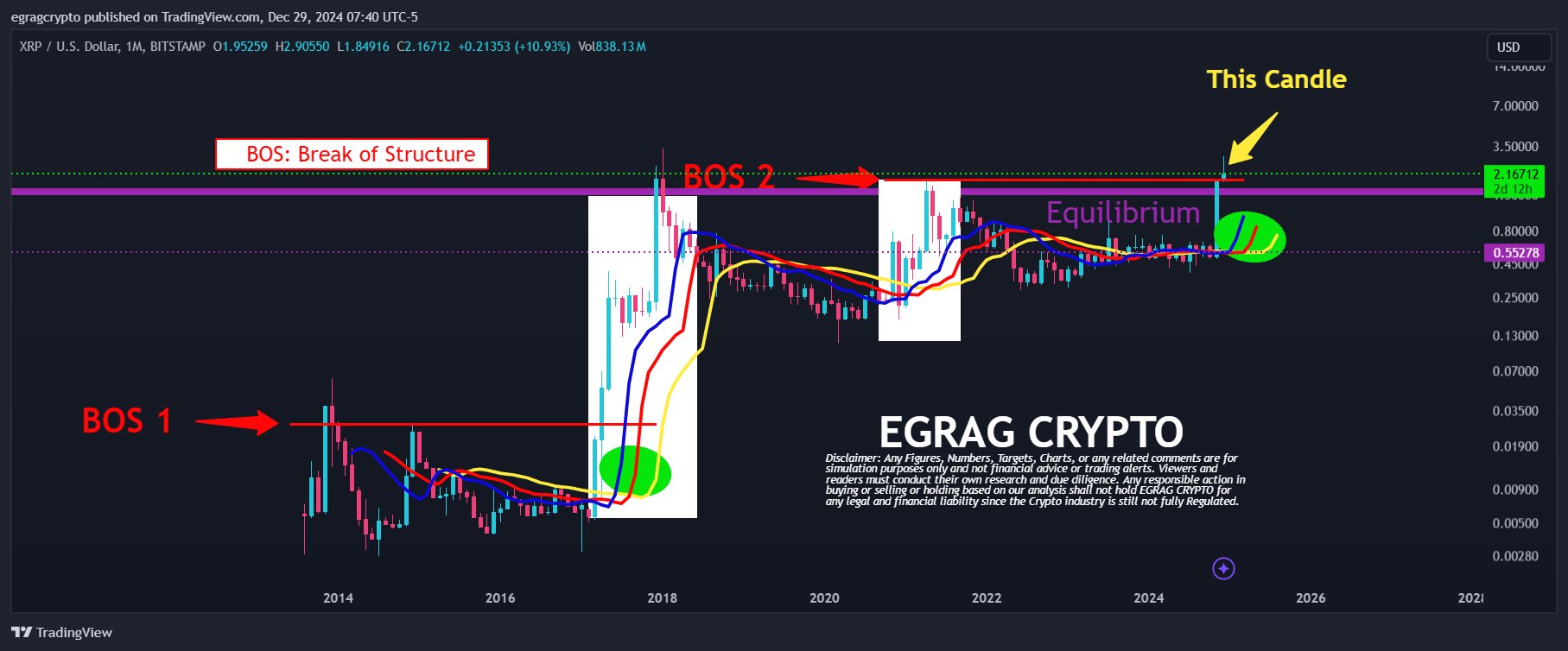

Egrag’s chart highlighted two critical “Break of Structure” (BOS) points on XRP’s long-term chart. The first incident occurred in the first week of 2018 when XRP broke its all-time high. There was a similar attempt in 2021, but it failed to propel XRP to a new all-time high.

A new structural break is currently emerging, with XRP trading above the $2 equilibrium level. The Williams Alligator indicator is showing a consensus, suggesting a possible continuation of XRP’s uptrend.

For comparison, a similar bias was seen at the end of 2017, and in January 2018, XRP was trading at an all-time high of over $3.80.

While the current observation is promising, Eggag warns that confirmation depends on the upcoming monthly candles. He noted that the current monthly candle appears bearish.

The opening and closing of the…