As Cardano’s downward spiral continues, data shows that the asset must hold key demand zones to avoid sharper price declines.

Cardano (ADA) continues its trend below the psychological $1 price mark. The ninth-largest cryptocurrency by market capitalization fell below valuation in mid-December and capitulated further to a monthly low of $0.7620.

Meanwhile, the Bears carry on dominate Happenings in the crypto market, with Cardano recording its third consecutive weekly downtrend last week. Amid the correction, data has shown Cardano’s crucial support levels.

Critical levels for Cardano

The analysis of IntoTheBlock insight has pointed to a strong demand wall that could prevent further downside for Cardano. Show data that 223,070 wallets acquired 1.97 billion ADA between the prices of $0.8366 and $0.6683, representing the first major support for Cardano should bearish pressure continue. Bulls can use this area to hedge against a sharper decline to $0.65.

Additionally, there is another support wall between $0.5353 and $0.6683, where 405,660 addresses purchased 5.39 billion ADA at an average price of $0.5973. This second wall of demand could provide additional support if the first wall breaks.

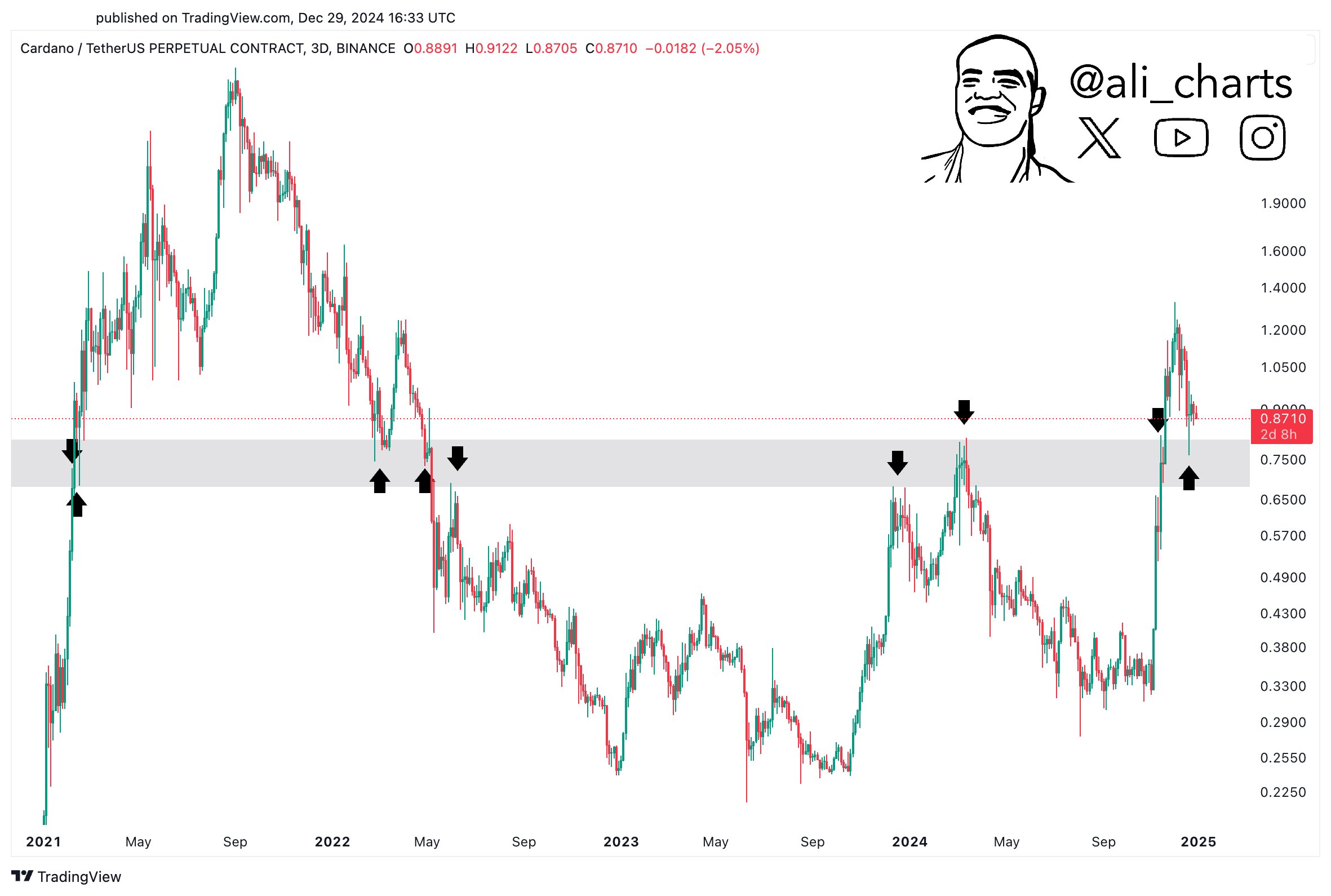

Furthermore, market data shows that Cardano has another support level between $0.68 and $0.77. According to trend analysis, the demand zone has detected Cardano’s historical price movement on multiple occasions.

Price action confirms the importance of the level

Meanwhile, Cardano’s price movement between the $0.5973 and $0.7556 demand zone confirms the importance of this level for a price…