Decentralized finance (DeFi) protocol Aave is exploring integrating Chainlink.

Chainlink’s newly launched Smart Value Recapture (SVR) oracle aims to address inefficiencies related to Maximum Extractable Value (MEV).

A proposal on Aave’s governance forum suggests that this move could see up to 40% of MEV profits returned to the protocol’s users, potentially improving equity within its ecosystem.

The MEV dilemma

MEV refers to profits made by block builders who rearrange transactions for financial reasons before completing blockchain entries. While this practice is lucrative for builders, it often comes at the expense of DeFi users. Aave, which enables borrowing through collateralized crypto assets, faces significant MEV-related challenges during liquidation events.

Source: X

Liquidations occur when the value of collateral falls below a predefined threshold, allowing third-party liquidators to repay debt and claim collateral with an additional liquidation bonus. While this mechanism was effective, it increasingly allowed blockbuilders to earn profits disproportionate to their contributions, according to Aave’s governance proposal.

“A problem has recently emerged that requires optimization: MEV,” the proposal states.

Chainlink’s SVR solution

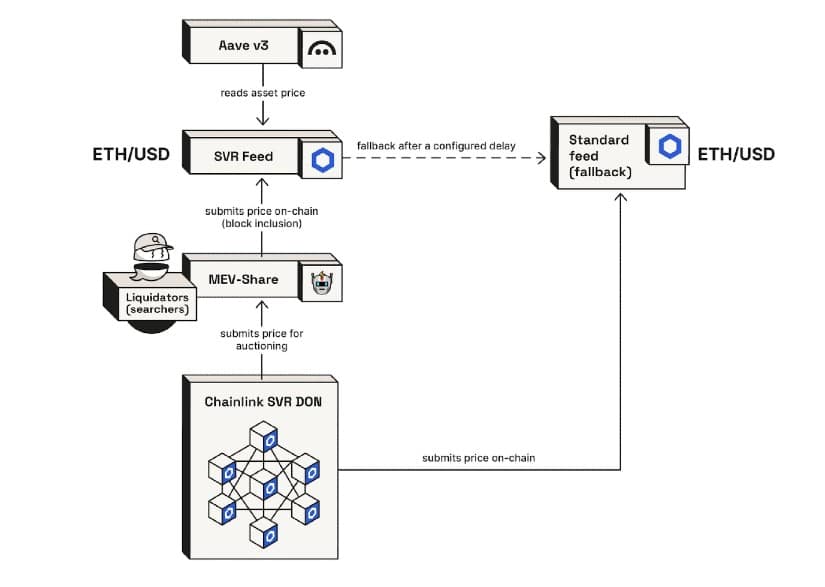

Launched on December 23rd, Chainlink’s SVR oracle aims to address MEV inefficiencies by selling rights to underpin its price feed oracle through a MEV stock auction.

SVR chart. Source: Avae

The captured profits are then passed on to participating DeFi protocols. If integrated, this service could allow Aave to reclaim MEV profits made during liquidations and return them to its…