The digital asset market suffered a significant downturn in December, with exchange traded products (ETPs) losing a total of $17.7 billion in assets under management.

According to a Dec. 23 report from CoinShares, the sharp decline is related to economic uncertainties and market reactions to changing monetary policy.

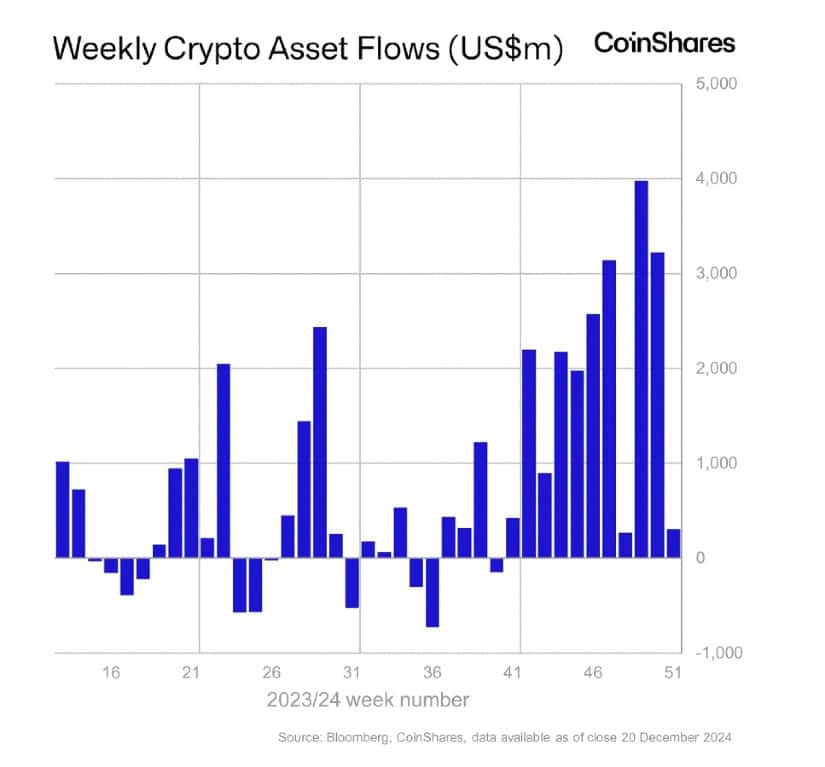

Source: CoinShares

A significant portion of this decline occurred between December 19 and 20, when more than $1 billion exited digital asset funds. CoinShares attributes this to waning enthusiasm after the Federal Reserve decided on December 18 to cut the key interest rate by 25 basis points, bringing it down to 4.25% to 4.50%, the lowest level since February 2023. Despite After the cut, forecasts pointed to a slowing pace of further cuts, dampening investor sentiment.

The outflows were concentrated in foreign markets. Germany, Sweden and Switzerland withdrew a total of $212 million, while Canadian markets posted losses of $60 million in the same week. Multi-asset products were also hit hard, with outflows of $121.4 million.

US market leader with inflows of $567 million

In contrast to the losses, the US market recorded inflows of $567 million, leading some regions that bucked the general trend. Brazil and Australia followed suit, bringing in $16 million and $10 million, respectively. The uneven performance highlights regional differences in investor confidence and strategies during the downturn.

Source: CoinShares

Bitcoin emerged as a top performer among digital assets, attracting $375 million in inflows despite fluctuations within the week. Ether also recorded positive developments: $51 million flowed into its funds. Solana…