Bitcoin, the world’s largest cryptocurrency, has come under renewed pressure after falling more than 7% last week. This marked the first significant weekly decline since President-elect Donald Trump’s victory in the November 5 election.

The sharp decline is attributed to a combination of several factors, including the Federal Reserve’s recent hawkish stance on interest rates and general market unrest regarding cryptocurrency exchange-traded funds (ETFs).

Source: BNC Bitcoin Liquid Index

In recent weeks, the global cryptocurrency market capitalization has fallen below the $3.5 trillion mark, losing about $500 billion, according to the Federal Reserve’s December 17 statement. Bitcoin, which rose to a new all-time high of just over $108,000 last Tuesday, is currently trading at around $93,245, a double-digit loss in less than seven days.

Fed comments trigger big ETF outflows

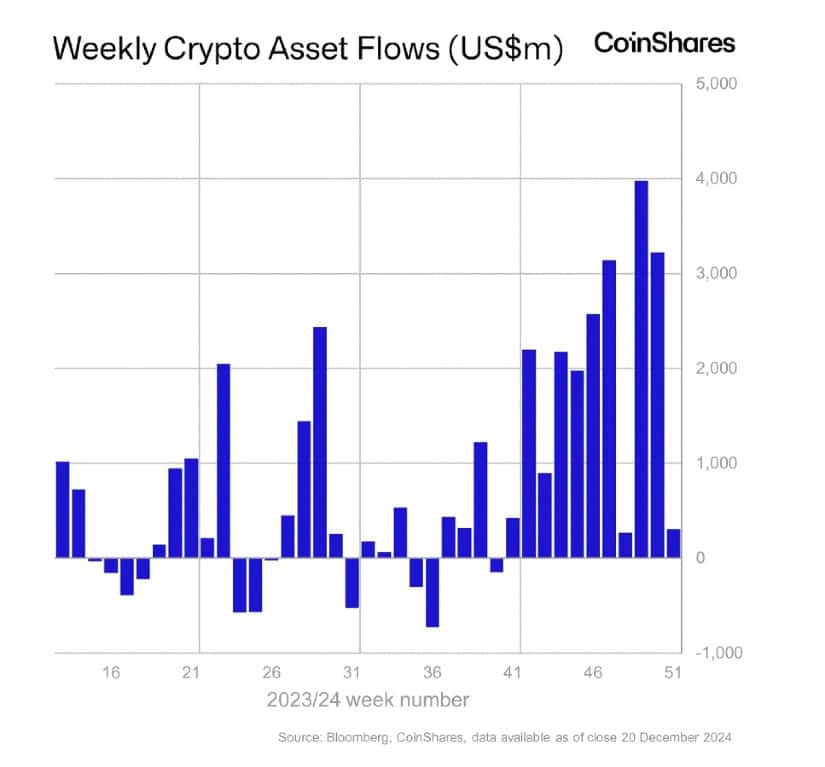

Adding to Bitcoin’s woes, cryptocurrency ETFs saw record outflows last Thursday after Fed Chairman Jerome Powell warned that rate cuts in 2025 would not be as aggressive as some had hoped. According to European fund manager CoinShares, investors withdrew $576 million in one day alone, bringing total outflows to $1 billion by Friday. This dramatic shift in sentiment followed a strong inflow of $3.2 billion into crypto funds the week before.

Source: CoinShares

Analysts believe that rising interest rates could continue to weigh on risky assets. Historically, Bitcoin has performed better in lower interest rate environments, which often leads to speculative investing in cryptocurrencies. As market participants now prepare for less…