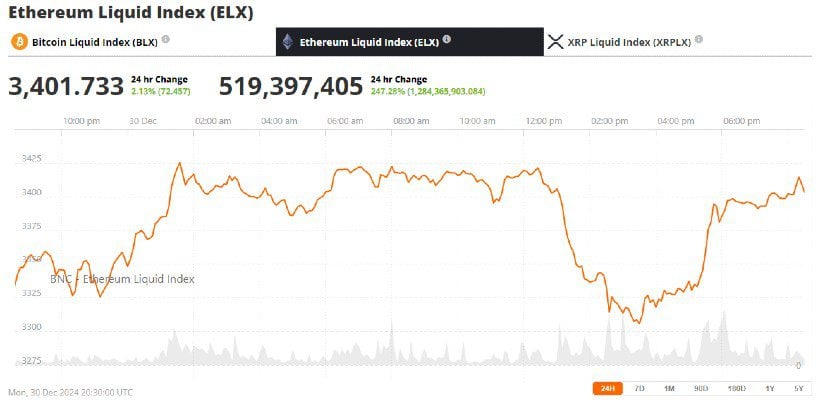

Ethereum (ETH) has remained in a tight trading range between $3,300 and $3,500 for the past two weeks. This sideways movement gave traders and investors hope for signs of recovery. What is the ETH price prediction for 2025?

Several market indicators suggest that Ethereum ETH could be preparing for a breakout in early 2025. For investors wondering which crypto coins to buy, ETH remains a strong prospect.\

Source: Ethereum Liquid Index from Brave New Coin

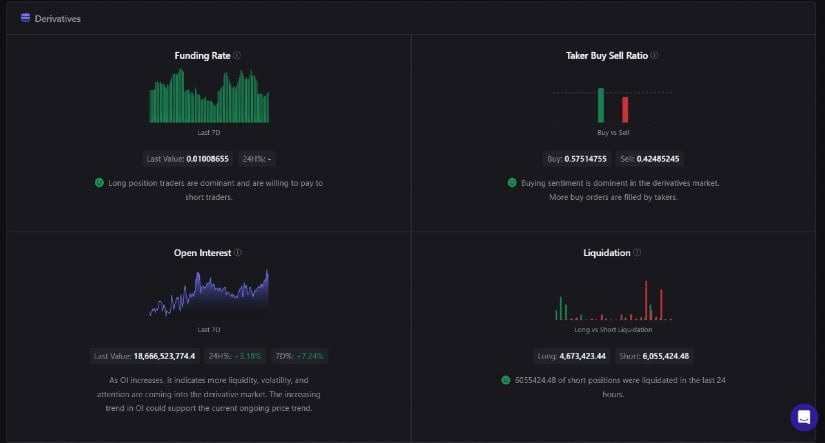

Recent insights from CryptoQuant analyst Burak Kesmeci shed light on the dynamics of the Ethereum futures market. Kesmeci highlighted four key metrics – funding rate, buyer-buy-sell ratio, open interest and liquidations – that have played a crucial role in shaping Ethereum’s price movement.

Source: CryptoQuant

The financing rate was a healthy 0.01 at the time of the analysis. This figure shows that traders in long positions are confidently supporting the Ethereum spot market, a promising sign of sustainable stability. Additionally, the taker buy-sell ratio of 0.57 highlights a prevailing buying sentiment among derivatives market participants, which could potentially fuel demand-driven price increases.

Bullish indicators are fueling investor optimism

Open interest, a measure of market activity, saw a slight increase of 3.18% in 24 hours. This increase signals renewed interest in Ethereum derivatives, although it appears to be a short-term trend. Meanwhile, $6 million worth of short positions were liquidated over the same period. The active liquidation of these bearish bets reduced selling pressure and counteracted the impact of increased open interest.

The sales facilitation…